Twin Cities real estate brokers have been saying since the start of the year that there weren’t enough industrial buildings on the market to satisfy investors wanting to buy into that market. Now that the year is over, the numbers are in that prove their point.

The Twin Cities industrial real estate market saw both record overall sales in 2019 and the highest price ever paid for a portfolio of industrial buildings. Total sales hit about $1.29 billion, according to data compiled by Real Capital Analytics and records on file with the Minnesota Department of Revenue. That’s up from the previous record of $1.21 billion set in 2018.

The industrial market seems ready to continue to defy the cyclical trends that have long ruled the commercial real estate market, said Mark Kolsrud, a senior vice president with the Investment Services Group at Colliers International’s Twin Cities office. Industrial sales will likely hit another record in 2020 as warehouse and industrial space users continue to demand more space for their operations.

“It seems like a never-ending party,” Kolsrud said in a Monday interview.

Kolsrud’s team represented the seller in the biggest industrial deal of the year, a $247.2 million sale last spring of a 34-building portfolio to Chicago-based Blackstone Real Estate Investment Trust. The deal eclipsed a $96 million portfolio transaction that was the year’s second-largest, and the top four industrial portfolio sales from 2018 combined.

Colliers expects to close on a couple more big Twin Cities industrial portfolios this year, said Kolsrud and colleague Colin Ryan. Two of the biggest players in the national industrial market, Blackstone and San Francisco-based Prologis, are driving big-dollar sales, Ryan said.

“It’s really kind of an arms race nationally between Proligis and Blackstone,” he said.

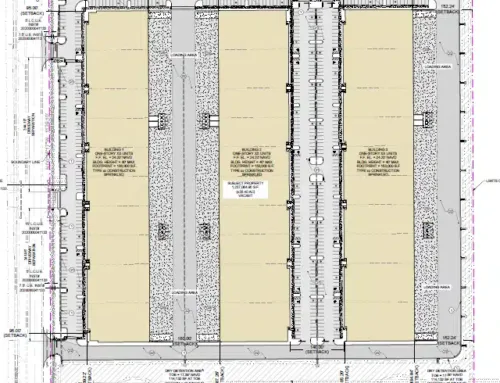

Local developers including Minneapolis-based Hyde Development will be among the players in building more industrial space for users and investors. Hyde, which is partnered with Golden Valley-based M.A. Mortenson Co. on a number of projects, is seeking to increase the size of its portfolio to the point at which it may become attractive to the biggest investment players, said Hyde co-founder Paul Hyde. “To be active in that market, we have to grow and we have to have scale,” he said in an interview.

Hyde will spend 2020 seeking out increasingly rare industrial development sites for new buildings, selling some assets and repositioning existing properties, Hyde said. The company will even make unconventional “covered land plays” in which Hyde will buy existing businesses that will continue to operate until such time it becomes feasible to redevelop those properties.

“We’re trying different things to get to that scale,” he said.

Whatever space gets built in 2020 will likely fill quickly. Vacancy rates in industrial properties remained low throughout the first nine months of the year, starting out at 4.3% and increasing slightly by the end of September to 4.4%, according to statistics compiled by the Minneapolis office of CBRE. Leasing filled much of the new and existing space on the market, with total space absorption hitting 3.2 million square feet in the first three quarters of 2019.

Portfolio transactions

1. Chicago-based Blackstone Real Estate Investment Trust paid more than $247.2 million in cash on April 18 for 34 industrial properties throughout the Twin Cities. The deal was the largest industrial portfolio sale ever in the metro area. Minneapolis-based Industrial Equities was the seller. The price for the 2.245 million square feet of space enumerated in public sale documents works out to $110.11 per square foot. The Twin Cities office of Colliers International represented the seller.

Industrial and office space at 739 Vandalia St. and 2210 Territorial Road W. in St. Paul constitute two of the properties Capital Partners and DRA purchased as part of a $96 million industrial portfolio.

2. A joint venture between Minneapolis-based Capital Partners and New York-based DRA Advisors paid $96.05 million on Sept. 27 for a portfolio of 18 industrial properties in the St. Paul Midway. The deal for the 1,851,165-square-foot portfolio worked out to about $51.89 per square foot of space. The Twin Cities office of Colliers International represented the seller.

The real estate arm of Travelers purchased a 277,075-square-foot FedEx facility 8450 Revere Lane in Maple Grove along with two other Twin Cities buildings for almost $65 million.

3. The New York-based real estate arm of Travelers Insurance paid $64.6 million for a three-building portfolio on Feb. 6. Properties purchased in the transaction were 8450 Revere Lane in Maple Grove, the Northern Stacks I distribution warehouse at 41 Northern Stacks Drive NE in Fridley and 20000 Diamond Lake Road S. in Rogers. The deal for the 778,694-square-foot portfolio worked out to about $82.96 per square foot of space. The seller was an entity related to New York-based Gramercy Property Trust. The Minneapolis office of CBRE represented the seller.

The 184,646-square-foot Northland Interstate Business Center IV at 9300 75th Ave. N. in Brooklyn Park was the priciest piece of Onward’s industrial portfolio purchase at $14.7 million.

4. Plymouth-based fertilizer maker Mosaic Co. paid $43.3 million on April 10 to buy a set of warehouses at 5300 Pine Bend Trail in Rosemount. The buildings, which date to 1966 and 1980, have a total of 621,098 square feet of space. The seller was another fertilizer maker, CF Industries of Deerfield, Illinois.

5. Eden Prairie-based Onward, in a joint venture with investment fund sponsored by New York-based AIG Global Real Estate, paid $41.5 million on Sept. 27 for three Brooklyn Park industrial buildings and a flex building in Minnetonka. The deal for the 450,727-square-foot portfolio works out to about $92.07 per square foot. The Twin Cities office of Colliers International represented the seller.

Individual Building Transactions

The 334,988-square-foot, Anoka Corporate Center at 3500 Thurston Ave. in Anoka, home to DecoPac since 2006, sold as the most expensive industrial building in the Twin Cities in 2019 that was not part of a Minnesota portfolio.

1. An entity related to Chicago-based Centaur Capital Partners paid $28.25 million in cash for the 334,988-square-foot Anoka Corporate Center at 3500 Thurston Ave. in Anoka. The deal, which closed on Dec. 20, works out to about $84.33 per square foot of space. The building is the headquarters of cake decoration supplier DecoPac. The seller was an entity managed by former DecoPac CEO Michael McGlynn. The Twin Cities office of Colliers International represented the seller.

Toronto-based WPT Industrial REIT purchased this Lakeville warehouse at 9150 217th St. W. for $23.5 million.

2. WPT Industrial Real Estate Investment Trust paid $23.5 million in cash for a 282,100-square-foot single-tenant warehouse at 9150 217th St. W. in Lakeville. The April 5 sale works out to $83.39 per square foot. The building was the only one in Minnesota from a group of 13 buildings WPT purchased from FR/Cal Interstate South LLC. The overall deal, which spanned Minnesota, Wisconsin, Illinois, Florida and California, was worth $226 million.

The Skyline Exhibits building at 3355 Discovery Road in Eagan is remains fully occupied by the company that had it built after the property sold last year for $23.3 million.

3. Boston-based STAG Industrial paid $23.3 million in cash on Nov. 4 for the Skyline Exhibits building at 3355 Discovery Road in Eagan. The 626,722-square-foot warehouse was built in 1998 by Skyline Displays Inc. The seller was Hendricks Commercial Properties. The deal works out to $37.18 per square foot of space.

Arrowhead Electrical Products leases all 248,816 square feet of 3705 95th Ave. NE in Blaine. United Properties sold the building for more than $21 million in 2019.

4. STAG Industrial paid $21.9 million in cash on Jan. 30 for the 248,816-square-foot Blaine Preserve Business Park III at 3705 95th Ave. NE in Blaine. The seller is an entity that shares an address with the building’s developer, Minneapolis-based United Properties. The purchase, which closed on Jan. 30, works out to $88.02 per square foot of space.

A 135,000-square-foot building at 1451 Dean Lakes Trail in Shakopee occupied by Bayer CropScience was at peak value when a Ryan Cos. US Inc. entity sold it in 2019.

5. STAG Industrial paid $17.55 million on Nov. 5 for a 135,000-square-foot building at 1451 Dean Lakes Trail. Fully leased to Bayer CropScience, the building was the last that seller Ryan Cos. US Inc. built at the 90-acre Dean Lakes Business Center. The deal works out to $130 per square foot or space.

By: Matt M. Johnson January 6, 2020 4:12 pm

https://finance-commerce.com/2020/01/top-industrial-sales-of-2019-market-was-a-record-setter/